What's the Best Alternative to the Maybank 2 Cards Premier?

- Refined Points

- Jun 14, 2024

- 6 min read

Yet another month has passed, and the monthly allocation for converting TreatsPoints into airline miles has been exhausted on the very first day of June.

This recurring situation has sparked considerable frustration among Maybank’s loyal credit cardholders, evident from the flurry of grievances shared across social media platforms and forums. Unfortunately, from a consumer’s standpoint, there appears to be no recourse.

Despite the apparent opacity of its practices, Maybank has adeptly navigated through the capping and devaluation of TreatsPoints, ensuring all modifications comply with Bank Negara’s regulations.

Given the ongoing developments and having already penned two articles on the topic in recent months, it seems timely to explore this issue further.

Let Your Money Talk

The widespread devaluation of TreatsPoints has left countless Maybank cardholders contemplating the cancellation of their credit cards. The main concern isn’t merely the cancellation itself but rather the substantial number of TreatsPoints trapped in their accounts, which they cannot convert into airline miles.

With no foreseeable resolution, one thing becomes unequivocally clear: continuing to use your Maybank 2 Cards Premier will not facilitate the conversion of your TreatsPoints into valuable airline miles.

Unless you’re content with redeeming your points for items like rice cookers—which represent a poor return on investment—I strongly advise you to cease all spending on your Maybank credit cards forthwith. Cancel your cards and start exploring alternative options within the airline miles landscape.

With the market more competitive than ever, there are numerous better choices available. Frankly, even before this devaluation, Maybank’s offerings for accumulating airline miles were already declining in appeal.

The TreatsPoints Strategy

As emphasized in my recent live consultations, there’s no immediate urgency to convert your TreatsPoints into airline miles. Indeed, those fortunate enough to have processed conversions before the devaluation on May 22, 2024, are in a favorable position.

However, for the majority who missed this opportunity, it’s important to approach the situation with patience. I do not anticipate another significant devaluation from Maybank in the near to medium term. Implementing further reductions would likely draw regulatory scrutiny from Bank Negara and provoke additional backlash from already dissatisfied cardholders.

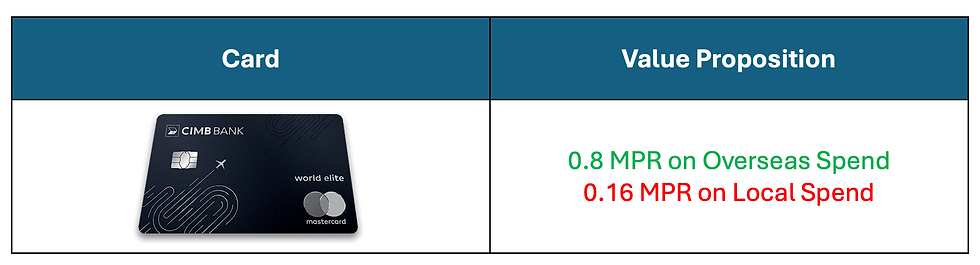

From a business perspective, it seems improbable that Maybank would jeopardize its reputation further, especially as it prepares to launch the new Mastercard World Elite credit card. Therefore, it may be prudent to accept the current conversion rates. If you’re aiming to redeem flights in the upcoming months, it’s possible that award seats are already scarce. Even looking towards the end of 2024, the prospects for high-value redemptions are dwindling.

With this in mind, it might be wise to begin planning your travel for 2025. By doing so, you can take advantage of award availability as soon as tickets are released—often 365 days in advance, though specific timing can vary by airline. Consider converting your TreatsPoints in the latter half of 2024, positioning yourself for early bookings and potentially concluding your relationship with Maybank once these transactions are complete.

Picking the Right Credit Card Strategy

With a strategy now in place for your unused TreatsPoints, it’s prudent to explore other credit card options that better align with your goals for airline miles accumulation. Many readers of Refined Points have already transitioned to banks offering more favorable terms for accumulating miles.

As we pivot to the core discussion of this article, it’s vital to concentrate your research on selecting a credit card strategy that matches your spending habits, rather than just opting for the card that offers the best miles accrual but comes with high annual fees.

For instance, I’ve observed individuals applying for the CIMB Travel World Elite, only to later express dissatisfaction with the RM1215 annual fee and the less-than-ideal overseas earning rate—especially if they seldom travel abroad.

The same goes for those who rushed to apply for the UOB PRVI Miles Elite, not knowing that it offers a stellar 1.11 MPR on overseas and foreign currency spend but has a lacklustre local earning rate.

Choosing the right credit card is essential, but it’s also crucial to consider potential future devaluations and assess whether the cards are relatively “future-proof.” Take, for example, UOB’s current offerings, such as the UOB PRVI Miles Elite, which provides an impressive 1.11 MPR on overseas and foreign currency expenditures.

Imagine a hypothetical 42% devaluation: you would then require approximately 12,780 UNIRM points to redeem 1,000 airline miles, reducing the MPR to 0.78 for overseas spending. Even with such a significant devaluation, the UOB PRVI Miles Elite would remain among the top five credit cards in Malaysia for foreign transactions.

This suggests a buffer against potential devaluations, which may not drastically alter the card’s overall value proposition—unlike what occurred with the Maybank 2 Cards Premier, which post-devaluation, ranks poorly in its income segment for airline miles accumulation.

My Top Picks for Airline Miles Strategies

In this section, we delve straight into the essentials. Below are some of my top recommendations for optimal airline miles strategies, each with its merits and drawbacks.

For a deeper understanding, please refer to the full reviews of the credit cards listed on Refined Points. These strategies are tailored for those with an annual income of RM100,000 or below.

Alliance Bank Visa Infinite & Visa Platinum

Pros: Earns 0.53 MPR on all spending via E-Wallet reloads, with easily waivable annual fees.

Cons: Monthly cap of RM6,000 across both cards; only allows conversion to Enrich miles.

UOB World Card + UOB PRVI Miles Elite

Pros: UOB’s points pooling earns you 0.55 MPR on groceries, 1.33 MPR on E-Wallets, 0.55 MPR on airline expenditures, and 1.11 MPR on overseas/foreign currency spending.

Cons: E-Wallet capping at RM300 per card and a combined annual fee of RM1,200 if not waived.

CIMB Visa Infinite + CIMB Travel World Mastercard

Pros: Points pooling by CIMB provides up to 0.64 MPR on dining, airlines, and foreign currency spend. No annual fee for the CIMB Visa Infinite.

Cons: Lower MPR compared to UOB; primarily beneficial for those converting to frequent flyer programs like Avios and Asia Miles.

Standard Chartered Journey Mastercard

Pros: Offers 0.5 MPR on dining and airlines, 0.5 MPR on overseas spend, and 0.1 MPR on other local expenditures. Requires a lower annual income (RM90,000) and has a RM600 annual fee.

Cons: Provides a lower MPR on local spend (0.1 MPR less) compared to the Maybank 2 Cards Premier.

These recommendations provide a snapshot of the options available, allowing you to tailor your credit card strategy to fit your spending habits. While there are numerous other combinations worth considering, these four provide a solid foundation for those looking to optimize their airline miles accrual.

Final Thoughts

With the dynamic landscape of the financial sector in Malaysia, there is undoubtedly a credit card strategy out there that will serve as a perfect replacement for your Maybank 2 Cards Premier. The imminent launch of the Ambank Enrich credit cards, for instance, is set to make the airline miles market even more competitive—good news for consumers seeking diverse options.

Having transitioned away from the Maybank 2 Cards Premier myself in late 2022, I can confidently say that moving on was a wise decision. It’s crucial not to fall victim to brand comfort—remaining with a provider simply because of familiarity. Remember, a subpar strategy and inadequate customer service should not overshadow the need for an effective product.

In my case, moving away from Maybank was a relief. While I fondly recall using my accumulated TreatsPoints for a memorable trip to London in June 2023, I am even more pleased with the choices I’ve made since.

These strategies provided here are merely a starting point to guide you in adopting a new credit card strategy. This isn’t an exhaustive list, as the ideal strategy will vary based on individual spending patterns. You might be surprised to learn just how unconventional my own spending habits are, necessitating a unique combination of credit cards tailored to my needs. This adaptability and willingness to explore can lead you to discover the most beneficial credit card strategy for your lifestyle.

Enjoy your research and be sure to check out my Enrich Ultimate Guide, KrisFlyer Ultimate Guide, Asia Miles Ultimate Guide and Ultimate Category-Specific Guide to find the best credit card for airline miles accrual that suits your needs.

If you're a fan of airport lounges, be sure to also check out my Airport Lounge Ultimate Guide.

Happy Travels!