WOW! Shocking Devaluation Hits Maybank Credit Cards!

- Refined Points

- Apr 30, 2024

- 3 min read

Updated: Aug 10, 2024

UPDATE: 1/5/2024 2.00p.m.

Fellow readers, sadly, the monthly redemption limit has been reached as everyone is rushing to convert their TreatsPoints to Airline Miles! I previously wrote about this monthly redemption limit in my article here.

It seems that Maybank expected such backlash, and that the monthly redemption limit was put in place specifically for this latest devaluation.

UPDATE: 1/5/2024 8.00p.m.

Based on what I've been reading on social media, it appears that the redemption limit for TreatsPoints for the month of May has also been reached!

Original Article:

In a startling twist, Maybank has once again devalued the air miles conversion rates for some of its most popular credit cards, only months after a similar cutback.

This recent move, effective from May 22, 2024, impacts major cards like the Maybank 2 Cards Premier, signaling a troubling trend for loyalty program enthusiasts. I previously wrote about the significant devaluation here, and it's truly interesting to see Maybank doing another round so quickly!

For context, the Maybank 2 Cards Premier previously suffered a significant cut to its TreatsPoints earning rate in December 2023, effectively reducing the card's value for many users.

A Closer Look at the Numbers

Maybank’s recent adjustments have inflated the TreatsPoints required for converting into air miles across several card types.

The previously more generous conversion rates, such as 7,000 TreatsPoints for 1,000 Enrich/KrisFlyer/Asia Miles, are set to jump to 10,000 TreatsPoints for the same number of miles.

Not only does this represent a steep increase, but it also puts Maybank cardholders at a considerable disadvantage compared to other banks offering more favorable conversion rates.

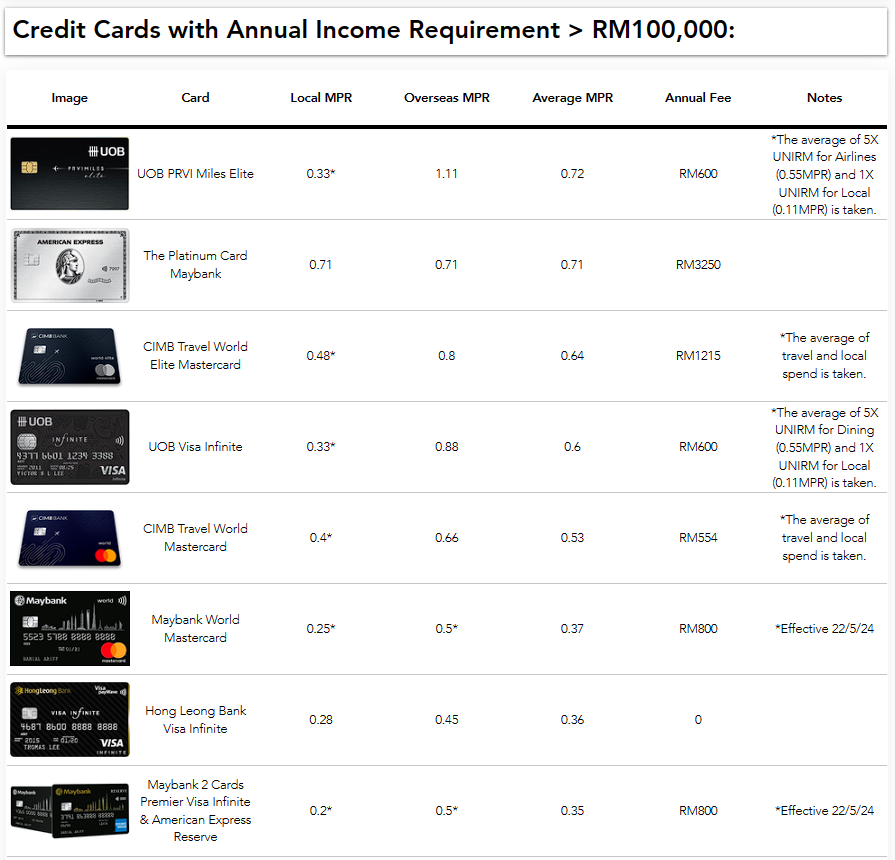

With the devaluation in place, I have updated my Enrich Ultimate Guide and KrisFlyer Ultimate Guide to reflect these changes. It's truly shocking to see the Maybank 2 Cards Premier falling below the RM0 annual fee Hong Leong Bank Visa Infinite credit card!

The Competitive Landscape

This devaluation strikes particularly hard as other financial institutions continue to enhance their rewards programs to retain and attract discerning customers.

Competitors such as CIMB and UOB have been introducing more lucrative deals and maintaining more stable conversion rates, making them increasingly attractive to those who prioritize earning potential from their spending.

Customer Reaction

Understandably, the response from the cardholder community has been overwhelmingly negative. With forums and social media buzzing with disappointed comments, it’s clear that Maybank may have underestimated the backlash and potential customer churn due to these changes.

Final Thoughts

Firstly, this latest devaluation by Maybank doesn't exactly come as a shock. Whisperings of turmoil within the company have surfaced, suggesting that this might just be the tip of the iceberg.

The Maybank 2 Cards Premier was once my go-to credit card until I severed ties back in 2022 following the initial devaluation. The decision was a no-brainer, especially given the tepid acceptance of American Express in Malaysia. Rumour has it that Maybank is looking to launch a Mastercard branded credit card in the near future, but is it really exciting at all?

Looking back, it was undoubtedly the right move. Since then, I've shifted my focus to other financial institutions that offer far more attractive rewards—a topic I might delve into another time.

Interestingly, despite its dwindling appeal, many continue to endorse the M2P card. I find a bit of solace in this, as it inadvertently benefits those of us who've switched to better alternatives.

In the grand scheme of things, it's a natural selection of sorts within the credit card ecosystem: the savvy reap the rewards, while the uninformed remain stuck with subpar options. It's harsh, but it's reality.

For dedicated travelers and rewards maximizers, the message is clear: it might be time to shop around. The era of relying on Maybank for optimal points to miles conversion seems to be drawing to a close, potentially ending its reign as the preferred choice for savvy flyers. This significant devaluation serves as a stark reminder that loyalty benefits are not set in stone and can shift dramatically at the institution's discretion.

Visit my Enrich Ultimate Guide, KrisFlyer Ultimate Guide and Asia Miles Ultimate Guide today to compare the best credit cards for earning airline miles in Malaysia.