On July 25, 2024, CIMB Bank has announced significant updates to their Member Rewards Program, significantly raising the threshold for converting Bonus Points to airline miles and hotel points.

I've heard this change coming for a while now, and it looks like its finally official. These changes will take effect from August 15, 2024, and are crucial for all CIMB credit cardholders who frequently redeem their Bonus Points for travel-related rewards.

It's important to note that this change isn't a devaluation of the points themselves but rather a significant increase in the minimum conversion threshold. The value of points remains the same, but the quantity required for conversion has increased fivefold.

Overview of the Changes

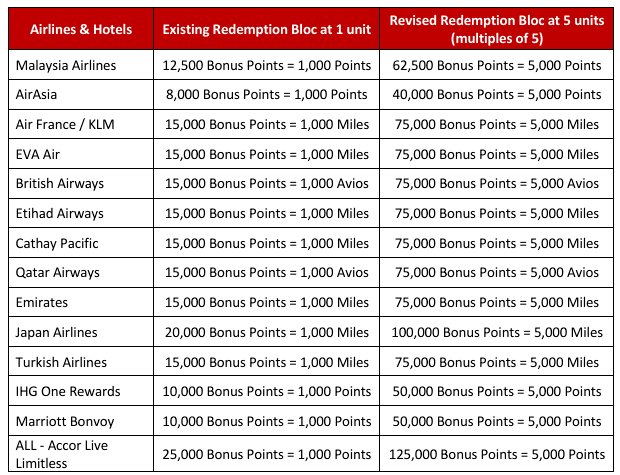

The new redemption system requires larger fixed increments for point conversions. Previously, cardholders could convert smaller units of Bonus Points to airline miles and hotel points.

For example, converting 12,500 Bonus Points to 1,000 Malaysia Airlines Enrich Points will now require 62,500 Bonus Points for 5,000 Enrich Points. Similarly, converting 8,000 Bonus Points to 1,000 AirAsia points will now require 40,000 Bonus Points for 5,000 AirAsia points.

Other partner airlines and hotel programs will also see conversions requiring multiples of 5,000 points or miles.

A Strange Move by CIMB

This new change by CIMB is quite puzzling. In the miles game, it's well known that a good majority of consumers don't convert their points to airline miles, leaving them in the bank.

Points represent a liability on the bank's balance sheet. Increased redemptions mean these liabilities are realized sooner, potentially impacting CIMB’s financial planning and cash flow.

This situation is profitable for banks because the burn rate—the rate at which points are redeemed—is low. However, with the new higher threshold, more consumers might immediately convert their Bonus Points to airline miles upon meeting the threshold. This increased burn rate could potentially increase CIMB's costs, making this move quite surprising.

For regional travelers, this change can feel like a devaluation. Most airline redemption tickets within ASEAN or Asia range from as low as 5,400 Miles to 30,000 Miles. The higher conversion threshold means that many customers will find themselves just a few points short of the required amount for conversion, causing frustration and potential dissatisfaction.

From CIMB’s perspective, this change might be seen as a strategy to enhance customer loyalty. By imposing a higher conversion threshold, CIMB believes that airline miles chasers would have no choice but to spend more to meet the minimum threshold, avoiding leftover or stranded points.

However, from a long-term perspective, this strategy might backfire as customers might not remain loyal to CIMB regardless of the airline miles conversion rate.

My Ongoing CIMB Credit Card Strategy

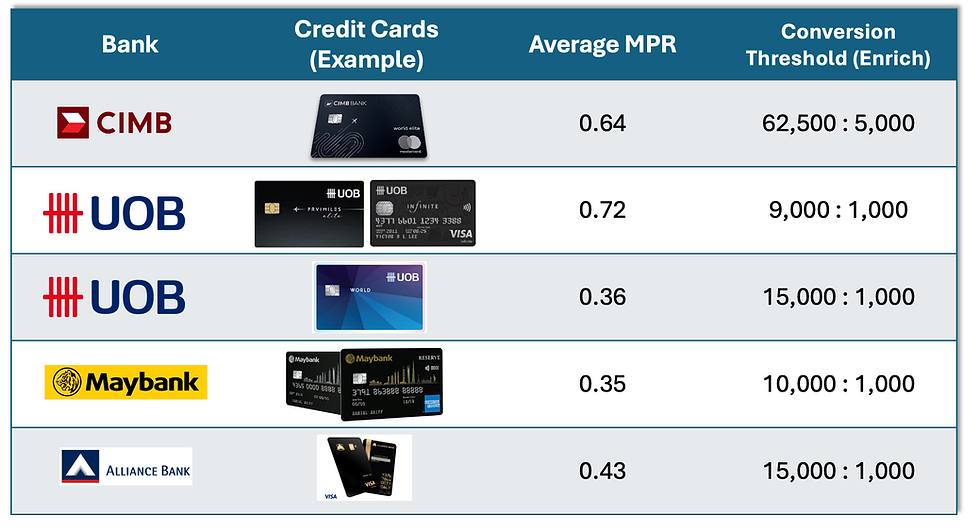

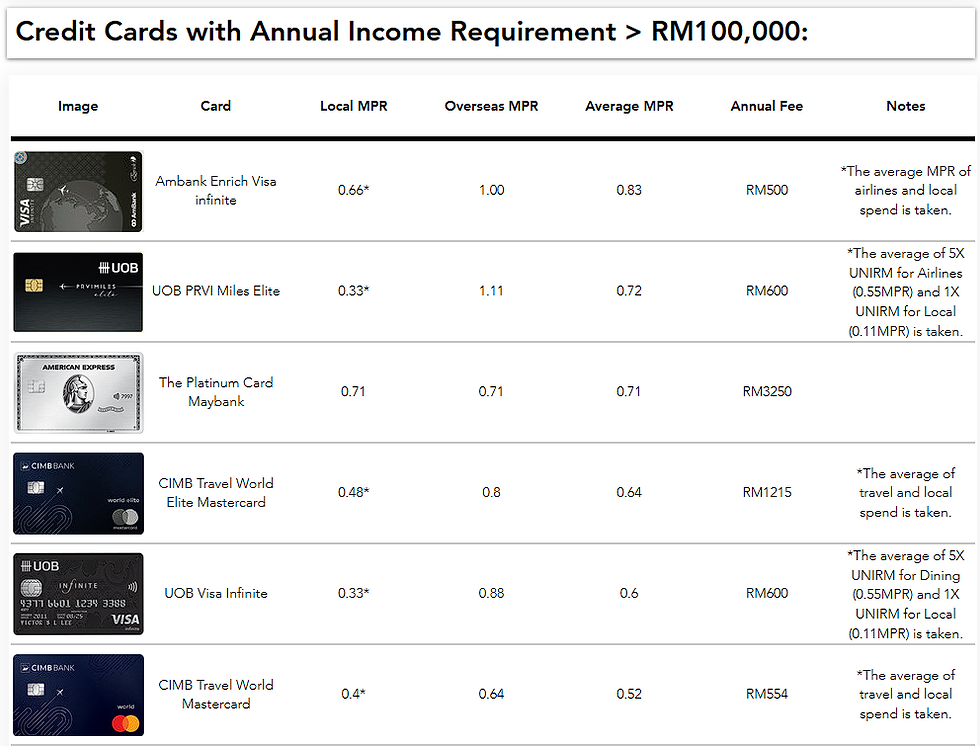

If you’ve been following my newsletters, you'll know that I am currently running on the CIMB ecosystem of credit cards. However, I've mentioned many times that CIMB credit cards do not offer the best Miles per Ringgit (MPR) conversions in Malaysia.

For instance, the top-tier CIMB Travel World Elite credit card has a 0.8 MPR on Enrich Miles for overseas spend, almost 40% lower than the UOB PRVI Miles Elite, which has a 1.11 MPR on overseas spend.

This discrepancy raises the question: why stay in the CIMB ecosystem? The answer lies in a certain airline frequent flyer conversion partner with a redemption rate that is essentially too good to be true, as detailed in my newsletters.

Final Thoughts

The imposition of a much higher threshold is a significant move. As I’ve mentioned in my newsletter, several exciting credit cards are coming up in the next few months. I’m closely monitoring the airline miles market to see if I will eventually make a strategic jump, and CIMB's latest change pulls me one step further away from staying with them.

Overall, this change is extremely puzzling. While I'm glad that it isn't an outright devaluation, the flexibility of redeeming airline miles quickly is essential for me.

I hope CIMB knows what it's doing here. It's not easy to forget the extreme backlash on Maybank credit cards over their recent changes. A small misstep in customer loyalty can have significant repercussions.

With UOB credit cards becoming more compelling, it’s hard to overlook the latest changes to CIMB.