Last Updated: 4/10/2024

Recommendation: Obtain

Annual Fee

-

RM600

-

Waived with RM50,000 Spend

Airport Lounge Access

-

12X Access

-

Regional Lounges

Annual Income

-

RM120,000 per annum

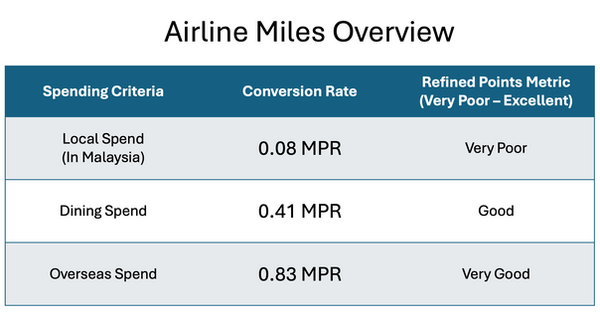

Airline Miles Earn Rate

Local: 0.08 MPR

Dining: 0.41 MPR

Overseas: 0.83 MPR

Payment Network

Review | UOB Visa Infinite

The UOB Visa Infinite stands out as a versatile credit card offering from UOB Malaysia, and remains a top recommendation from Refined Points even post-devaluation in September 2024.

It features attractive airline miles accrual rates and a suite of compelling benefits, making it an essential choice for those integrated into the UOB credit card ecosystem.

Read on to discover why this card is a valuable addition to your wallet.

Air Miles Conversion

Starting with the accrual of airline miles through local expenditures, the UOB Visa Infinite presents a nuanced offer.

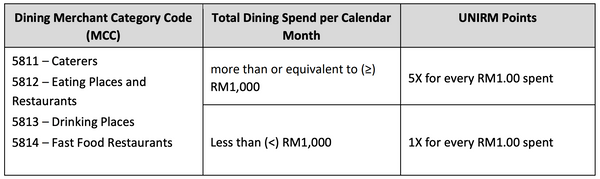

Although it provides a modest 0.08 MPR on general local spend, it awards a decent 0.41 MPR for dining, contingent upon a minimum monthly spend of RM1,000 on dining itself.

This feature is particularly advantageous, as I’ve noted in previous reviews, that credit cards favoring higher MPRs for e-wallet usage should be prioritized due to their widespread acceptance both locally and internationally. Following e-wallets, dining emerges as the next crucial category.

A credit card that rewards dining expenditures heavily deserves prime consideration, especially since dining out is one of the most frequent credit card uses today. This includes spending at cafes and coffee chains like Starbucks and Coffee Bean. With the UOB Visa Infinite, earning 5X UNIRM (equivalent to 0.41 MPR) on dining is indeed impressive.

Importantly, for business owners and client-facing consultants, it’s worth noting that the UOB Visa Infinite includes MCC 5813 under its dining category, which covers most bars, pubs, and drinking establishments. This feature allows you to accumulate a significant number of UNIRM, especially as expenditures on alcoholic beverages tend to be higher.

Furthermore, the RM1,000 minimum spend requirement is realistically attainable for most, as it can be easily met with your regular coffee and meal purchases alone, making this card an exceptional choice for those who frequent dining establishments.

Delving into specifics, the UOB Visa Infinite categorizes Dining under Merchant Category Codes (MCC) ranging from 5811 to 5814, encompassing caterers, restaurants, bars, and fast food outlets. However, it’s important to note that dining at hotel and resort venues usually falls under the MCC 7011, which differs from the typical dining codes, according to online research.

While it may not always be possible to know the MCC of every dining transaction, typical restaurant and café visits within malls should generally align with the designated dining MCCs. It’s crucial to highlight that the UOB Visa Infinite excels at accruing airline miles for dining-related expenses.

If dining out is not a regular part of your lifestyle, you might consider a credit card that offers superior miles per ringgit on grocery purchases.

For a detailed comparison of credit cards optimized for dining and groceries, be sure to refer to my newly published Ultimate Category-Specific Guide.

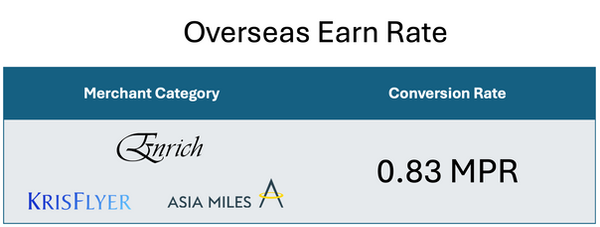

Turning our attention to overseas spending, the UOB Visa Infinite offers a robust airline miles accrual rate for international transactions, which is highly commendable.

In fact, with the recent UOB-wide devaluation in September 2024, the UOB Visa Infinite now has a much better value proposition than its Mastercard sibling, the UOB PRVI Miles Elite, which also offers the same 0.83 MPR on overseas spend, but lacks a dining accelerator.

Crucially, the UOB Visa Infinite, which sits on the Visa network, generally has lower foreign transaction fees compared to Mastercard's network. However, this usually differs based on the fees implemented by UOB themselves, so take it with a pinch of salt.

Overall, despite the recent devaluation in September 2024, the UOB Visa Infinite is a breath of fresh air in the realm of credit cards, offering generous rewards on international expenditures alongside a sensible rate for local dining.

While many cards geared towards airline miles accrual often feature higher overseas MPRs at the expense of local rewards, it’s refreshing to see a balanced approach with the UOB Visa Infinite.

Special Deep Dive: The Optimal UOB Strategy

The UOB Visa Infinite is a standout credit card in Malaysia, offering an excellent balance of 0.41 MPR on dining and 0.83 MPR on overseas spending, positioning it as a rare find that delivers the best of both worlds.

By channeling your expenditures through the UOB Visa Infinite, you could amass a noteworthy tally of airline miles. A notable limitation, however, is its lack of additional rewards for consolidating spending onto a single card, which is understandable given the inherent benefits already provided by the UOB Visa Infinite itself.

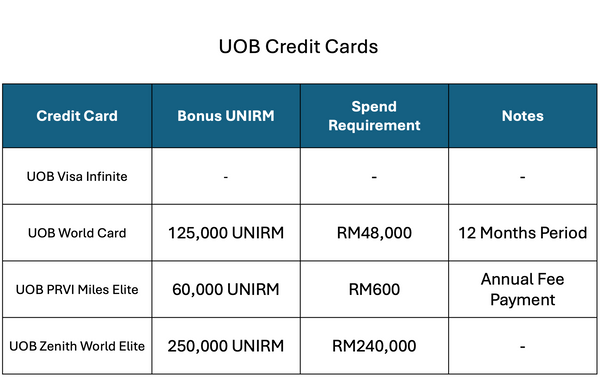

For instance, while the UOB World Card offers a bonus of 125,000 UNIRM for an annual spend of RM48,000, and the UOB Zenith World Elite grants 250,000 UNIRM for RM240,000 spent annually, introducing similar incentives for the UOB Visa Infinite could potentially overshadow its siblings, such as the UOB Visa Infinite Metal Card and the UOB PRVI Miles Elite, which cater to distinct user thresholds with their own unique rewards.

In my previous version of this review, I actually recommended obtaining the UOB PRVI Miles Elite to take advantage of its 1.11 MPR on overseas spend. However, with the recent devaluation, this is no longer an attractive proposition.

In fact, you would do perfectly fine having the UOB Visa Infinite as your sole credit card in the UOB ecosystem.

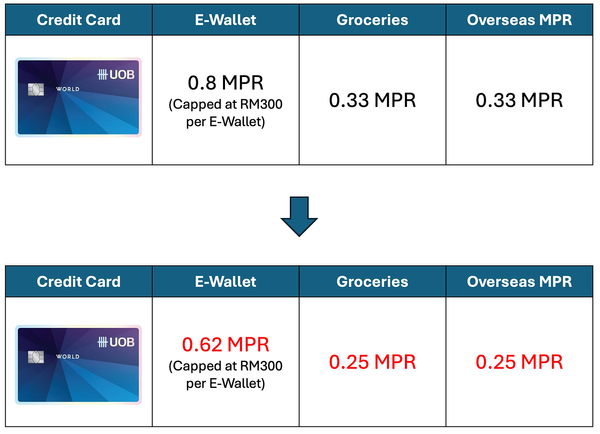

In fact, even the UOB World Card is no longer an attractive companion card in my eyes, given the recent devaluation that has reduced the MPR substantially, particularly for Groceries spend, which was honestly the only driving force for the UOB World Card.

With the laughable RM300 cap per E-Wallet in place, there is honestly no point for you to even consider obtaining the UOB World Card despite the 12X UNIRM headline, as it's simply not worth the annual fee and complication in tracking your caps each month.

If you ask me personally, the UOB Zenith World Elite may very well be the only credit card that you should consider as a companion alongside the UOB Visa Infinite, to take full advantage of its generous conversion rate of 7,400 UNIRM:1,000 Airline Miles.

However, this is effectively pointless if you don't actually utilize the benefits of the UOB Zenith World Elite, such as the complimentary stay perks, as I personally don't think the more attractive conversion rate justifies the hefty annual fee.

Special Deep Dive: UOB Birthday Reward

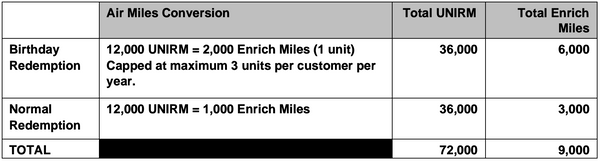

The UOB Visa Infinite offers a lesser-known but valuable feature: the Birthday Reward. This benefit allows cardholders to redeem double airline miles during their birthday month. To qualify for the Birthday Redemption, cardmembers must submit a redemption request within their birthday month.

The Birthday Redemption is capped at a maximum of three units per cardmember annually. Any subsequent miles redeemed in the same request will be processed under the Normal Redemption rate.

One unit is equivalent to 12,000 UNIRM, which translates to 1,000 airline miles. Therefore, three units provide a total of 3,000 airline miles, offering significant value to cardholders.

Airport Lounge Access

I know how important it is to obtain information about lounge access at a glance, so if you're queuing up to enter a lounge in Malaysia, here's the important details about the UOB Visa Infinite credit card:

-

Number of Lounge Access Passes: 12X per year (Via Dragonpass)

-

Supplementary Access: No.

-

Spend Conditions: No spend conditions

I've compiled the list of eligible lounges you can access in Malaysia. Lounge Access List by UOB Visa Infinite credit card in Malaysia:

-

Plaza Premium Lounge KLIA Terminal 1 Main Terminal Building

-

Plaza Premium Lounge KLIA Terminal 2 (Gateway@klia2)

-

Plaza Premium Lounge Penang International Airport International

-

Plaza Premium Lounge Penang International Airport Domestic

UOB Malaysia may update its list from time to time, so be sure to check out their list here if you don't see your lounge on the list above.

Lounge access for UOB Malaysia’s Visa Infinite credit cards, including the UOB Privilege Banking Visa Infinite and UOB Visa Infinite Metal Card, is facilitated through DragonPass.

The primary distinction between the UOB Visa Infinite and its Privilege Banking counterpart lies in the scope of lounge coverage. The UOB Visa Infinite card offers access exclusively to lounges within the Asia Pacific region, whereas the Privilege Banking Visa Infinite provides global lounge access.

Nonetheless, both cards grant entry to UOB’s exclusive section at the Plaza Premium Lounge in KLIA Terminal 1, an upscale extension of the Plaza Premium First, designed specifically for UOB’s elite clientele. I have detailed these lounges in separate articles, which I have hyperlinked above.

The lounge access provided by the UOB Visa Infinite is satisfactory, though it does not extend to supplementary cardholders. For those requiring wider lounge access for family or team members, the UOB PRVI Miles Elite is a preferable option, as it offers each supplementary cardholder their own lounge access.

Considering the RM120,000 credit line, it would be advantageous for UOB to enhance lounge access privileges, particularly in key international hubs like London.

Final Thoughts

The UOB Visa Infinite is a brilliant credit card in UOB's lineup of travel-focused credit cards, even after the devaluation in September 2024.

With its generous miles accrual rates for both dining and overseas expenses, it stands out as a robust choice for frequent diners and travelers alike. While the card does have limitations, such as its regional restriction on lounge access and lack of rewards for consolidating spend, its strengths in key spending categories make it a valuable contender in the crowded field of premium credit cards.

In conclusion, the UOB Visa Infinite may not suit everyone, particularly those who need comprehensive global lounge access or prefer a single card solution. However, for the discerning spender who can navigate its features to their advantage, it offers substantial rewards.

With the recent changes, there is no longer a need to couple it with other UOB cards like the UOB PRVI Miles Elite, as the UOB Visa Infinite is a strong contender on its own already.

Be sure to check out my Enrich Ultimate Guide, KrisFlyer Ultimate Guide, Asia Miles Ultimate Guide, Airport Lounge Ultimate Guide and my newly published Ultimate Category-Specific Guide to compare the best credit cards in Malaysia for earning airline miles.

Credit Card Updates

Credit Card News

Join the Mailing List

Subscribe to our newsletter to stay on top of the latest credit card updates and news.

Thank you for subscribing!

![[UPDATED] AmBank Drops KrisFlyer and Asia Miles for Non-Priority Banking Credit Cards](https://static.wixstatic.com/media/d8e41b_819de997e98e4044af9f3cd5983a1e73~mv2.png/v1/fill/w_318,h_179,fp_0.50_0.50,q_95,enc_avif,quality_auto/d8e41b_819de997e98e4044af9f3cd5983a1e73~mv2.webp)