Last Updated: 18/4/2024

Recommendation: Consider

Annual Fee

-

RM600

-

Waived with RM50,000 Spend

Airport Lounge Access

-

12X Access

-

Global Lounges

-

DragonPass

-

1 Guest

Annual Income

-

RM120,000 (RM500K AUM)

-

RM 1 Million AUM

Airline Miles Earn Rate

Local: 0.1 MPR

Dining: 0.5 MPR

Overseas: 1 MPR

Payment Network

Review | UOB Privilege Banking Visa Infinite

The UOB Privilege Banking Visa Infinite is a highly versatile credit card that stands on its own merits.

Boasting market‑leading miles‑per‑ringgit (MPR) rates and an attractive dining earn accelerator, Privilege Banking clients enjoy a strong balance of everyday and lifestyle benefits.

But with a minimum RM500,000 AUM requirement (or RM1 million for those without the RM120,000 income threshold), does it truly justify the commitment? Let’s find out.

Air Miles Conversion

To start off, the UOB Privilege Banking Visa Infinite offers 0.1 MPR on local spend, combined with 0.5 MPR on dining (requires a minimum RM1,000 dining spend per month).

At first glance, 0.1 MPR locally doesn’t dazzle—other UOB cards carry stronger base rates—but UOB appears to favour a companion‑card strategy, splitting category accelerators across multiple products.

In fact, female readers could pair the PBVI with the UOB Lady’s Solitaire to earn 0.5 MPR on retail, covering all your shopping needs.

That said, the 0.5 MPR dining rate feels a bit underwhelming next to the CIMB Preferred Visa Infinite, which asks for just RM250K AUM and delivers 0.53–0.64 MPR on dining, depending on the frequent‑flyer program. Even the no‑AUM UOB Visa Infinite posts 0.41 MPR on dining.

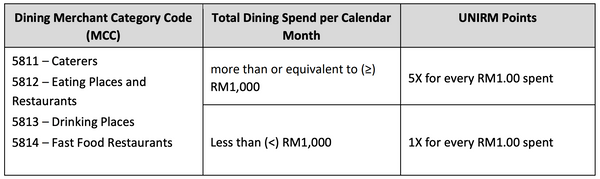

Delving into specifics, the UOB Privilege Banking Visa Infinite categorizes Dining under Merchant Category Codes (MCC) ranging from 5811 to 5814, encompassing caterers, restaurants, bars, and fast food outlets. However, it’s important to note that dining at hotel and resort venues usually falls under the MCC 7011, which differs from the typical dining codes, according to online research.

While it may not always be possible to know the MCC of every dining transaction, typical restaurant and café visits within malls should generally align with the designated dining MCCs. It’s crucial to highlight that the UOB Privilege Banking Visa Infinite excels at accruing airline miles for dining-related expenses.

If dining out is not a regular part of your lifestyle, you might consider a credit card that offers superior miles per ringgit on grocery purchases.

For a detailed comparison of credit cards optimized for dining and groceries, be sure to refer to my newly published Ultimate Category-Specific Guide.

On overseas spend, the PBVI’s 1 MPR is market‑leading, yet feels modest for a half‑million‑ringgit‑tier card. You can match that rate with the UOB PRVI Miles Elite in selected markets, proving UOB’s fiercest challenger is its own product lineup.

Since no other bank currently operates in the RM500K AUM segment, UOB has little incentive to boost earn rates—at least until a competitor drops a RM300K‑tier card with 20% higher MPRs.

Meanwhile, the CIMB Travel World Elite (RM1,215 annual fee) could theoretically vie for this same clientele—thanks to more versatile conversion partners—but CIMB hasn’t aggressively pursued that opportunity.

Airport Lounge Access

With the UOB Privilege Banking Visa Infinite, you get 12 DragonPass visits per year (plus one guest each time)—a clear upgrade over the regional‑only lounges afforded by the standard UOB Visa Infinite.

DragonPass now covers 1,000+ lounges worldwide, and continues to expand—especially in China’s and Japan’s domestic airports. Alongside Priority Pass and LoungeKey, these three networks ensure you’re covered even in remote terminals.

In Malaysia’s AUM‑based market, the Standard Chartered Priority Banking Visa Infinite rivals this perk via LoungeKey. While extra guest visits would sweeten the deal, nearly all UOB affluent cards already grant access to the UOB Private Lounge at KLIA Terminal 1, so family travel is well served.

Of course, you'll be glad to know that the UOB Privilege Banking Visa Infinite also grants you access to the UOB Private Lounge at KLIA Terminal 1, which is essentially an enclosed areas specifically catered by Plaza Premium Lounge for UOB credit cardholders.

Airport Limousine Benefits

Beyond miles and lounges, the PBVI offers two complimentary airport limo transfers per month (home ⇄ KLIA), provided you spend RM5,000 on airlines, hotels, or travel agencies—and even then, the service is capped at 7,000 redemptions annually.

Tying what should be a complimentary perk to a spend condition on a RM500K‑AUM card feels odd; worse, once the quota runs out, UOB isn’t obliged to notify you.

Cardholders frequently complain that UOB’s limo vehicles are dated and subpar, often inferior even to GrabCar Plus. Given that ride‑hailing can cost less, the limo benefit borders on marketing gimmick rather than genuine value.

Final Thoughts

As we’ve seen, the UOB Privilege Banking Visa Infinite delivers several standout perks:

-

Airline Miles:

-

0.1 MPR on local spend, offset by UOB’s companion‑card strategy (e.g., pairing with the UOB Lady’s Solitaire for 0.5 MPR on retail).

-

0.5 MPR on dining (with RM1,000 monthly spend)—solid but eclipsed by the CIMB Preferred Visa Infinite’s 0.53–0.64 MPR at half the AUM.

-

1 MPR on overseas spend—an industry‑leading rate you can also mirror via the UOB PRVI Miles Elite in select markets.

-

-

Lounge Access:

-

12 DragonPass visits per year (plus one guest), granting entry to 1,000+ lounges worldwide—far superior to the regional‑only access on the standard UOB Visa Infinite.

-

Only Standard Chartered’s Priority Banking Visa Infinite offers a similar global network via LoungeKey, making UOB’s DragonPass coverage a strong draw.

-

-

Other Perks:

-

Airport limo transfers (two trips/month) come with a RM5,000 travel‑spend condition and a 7,000‑redemption annual cap—tied to quotas and vehicle‑quality complaints, this feels more like a marketing gimmick than genuine value.

-

Given these points, the UOB Privilege Banking Visa Infinite might seem like an absolute must‑have from the eyes of airline‑miles connoisseurs, with its spectacular 0.5 MPR on dining, 1 MPR on overseas spend, and 12X global lounge access via DragonPass (plus guest).

However, all this comes with a hefty RM500,000 AUM commitment (or RM1 million without a RM120K income). With such substantially higher AUM requirements compared to its competitors, the UOB Privilege Banking Visa Infinite fails to distinguish itself with top‑of‑the‑line benefits.

In fact, I’d argue that obtaining the UOB Visa Infinite (which requires only RM120K income with no AUM) is enough—its benefit gap isn’t a deal‑maker.

Even more compelling is the CIMB strategy: pledge RM250K in AUM for the CIMB Preferred Visa Infinite’s superior dining earn rate, then combine it with the CIMB Travel World Elite for overseas spend. You save half the AUM while gaining access to CIMB’s extensive list of airline partners for redemption. In the long-run, the CIMB Travel World Elite's 1% Admin FX fee waiver may even offset some of it's annual fee drawdowns over the hefty AUM commitment.

Unless UOB enhances the PBVI’s benefits or a rival misses the chance to capture the RM300K‑tier market, the UOB Privilege Banking Visa Infinite risks being outflanked by more flexible, higher‑earning alternatives at a fraction of the AUM commitment.

Credit Card Updates

Credit Card News

Join the Mailing List

Subscribe to our newsletter to stay on top of the latest credit card updates and news.

Thank you for subscribing!