Last Updated: 14/10/2024

Recommendation: Obtain

Annual Fee

-

RM0

Airport Lounge Access

-

5X Access

-

International Lounges

Annual Income

-

RM60,000 per annum

Airline Miles Earn Rate

Local: 0.08 MPR

Dining: 0.4 MPR

Overseas: 0.4 MPR

Payment Network

Review | CIMB Visa Infinite

The CIMB Visa Infinite presents an intriguing proposition for consumers.

It may not be classified as exceptional, yet it offers a solid set of features and benefits. CIMB's recent revamp of the card, likely motivated by a desire to enhance its appeal to frequent travelers, has introduced notable improvements. However, the card's design remains curiously uninspired.

Let's explore its features in greater detail.

A Significant Reduction in Minimum Annual Income Requirement

A key adjustment to the CIMB Visa Infinite is the halving of the annual income requirement from RM120,000 to RM60,000. This strategic move by CIMB has reportedly sparked concern among competing banks, likely due to the previous lackluster airline miles conversion rate of the CIMB Visa Infinite in the RM120,000 annual income segment.

Notably, competing Visa Infinite cards from Maybank, UOB, and Hong Leong Bank, along with Mastercard offerings like the UOB PRVI Miles Elite, Maybank World Mastercard, and CIMB's own Travel World Mastercard, offered superior miles accrual rates at the higher income threshold.

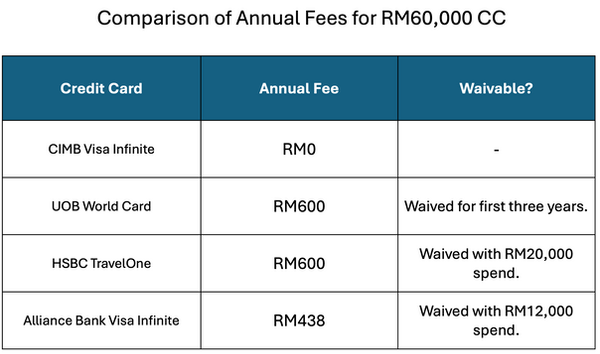

This reduction in income requirement now positions the CIMB Visa Infinite in direct competition with cards such as the Alliance Bank Visa Infinite, UOB World Card, and the HSBC TravelOne Mastercard.

The question arises: how does the revamped CIMB Visa Infinite fare against these competitors in terms of airline miles accrual?

Let us examine this further below.

Air Miles Conversion

The CIMB Visa Infinite's local airline miles earning rate presents an intriguing departure from conventional methods. Drawing inspiration from the successful tier-based reward system of the CIMB Preferred Visa Infinite, the card now offers a similar structure to its cardholders.

This involves granting bonus points in bulk upon exceeding specific monthly spending thresholds: RM3,000-4,999 (7,500 Bonus Points) and RM5,000 and above (15,000 Bonus Points).

To illustrate, spending RM5,000 or more in a month results in an automatic bonus of 15,000 Bonus Points. Capping specific spending categories at RM2,500 per month mitigates gamification, ensuring fairness and preventing excessive rewards concentration. This approach, while seemingly designed for the average Malaysian household with diversified spending patterns, rewards those who consolidate their spending onto one card.

However, a notable drawback is the overall capping and first-come-first-serve nature of the bonus points. This could lead to competition among cardholders aiming to secure these points each month, potentially diminishing the reward's appeal for some users.

Considering the RM60,000 annual income requirement, most cardholders will likely have a monthly income of RM5,000 or more. Realistically, reaching the RM5,000 spending threshold might prove challenging for many. Those consistently surpassing this threshold might find more advantageous options in higher income bracket credit cards.

Therefore, a more practical scenario involves targeting the RM3,000 spending threshold. This could translate to a typical monthly spend of RM1,000 on dining and RM2,000 on other local expenditures.

Combining bonus points from spending and the threshold bonus yields an Enrich Miles per Ringgit (MPR) of approximately 0.38, lower for other airline miles.

This local earning rate, while slightly lower than that of the Alliance Bank Visa Infinite, significantly outperforms the HSBC TravelOne Mastercard and rivals the UOB World Card with its bonus points on specific categories.

The CIMB Visa Infinite excels in overseas airline miles accrual amongst its competitors, offering a 0.4 MPR on foreign spending, which also contributes to the bonus point thresholds.

This MPR is the highest in its income category, surpassed only by the Standard Chartered Journey card with its 0.5 MPR but a higher annual income requirement of RM90,000.

Special Deep Dive: The Optimal CIMB Strategy

In 2023 and 2024, I have personally leveraged the CIMB credit card ecosystem for my own airline miles strategy. This began after canceling my Maybank 2 Cards Premier in late 2022, coinciding with CIMB's launch of their Travel credit cards. Despite other banks offering potentially more appealing airline miles accrual rates, my frequent travel to Europe necessitated a focus on Avios.

My combination of the CIMB Preferred Visa Infinite for local spending, the CIMB Travel World Elite for overseas spending, and the CIMB e Card for bonus points on the 28th of each month proved sufficient for my needs. CIMB's point pooling system allowed me to maximize benefits from both cards.

However, I previously hesitated to recommend CIMB credit cards to those not qualifying for higher annual income options due to their relatively lackluster airline miles accrual rates in lower income segments. The CIMB Visa Infinite changes this.

I now consider the combination of the CIMB Visa Infinite and the CIMB Travel World Mastercard (RM100,000 annual income requirement) a compelling strategy for those accumulating Avios or frequently traveling to Europe and the Middle East.

The CIMB Visa Infinite's local accrual rate complements the CIMB Travel World Mastercard's overseas accrual rate, creating a balanced approach.

The CIMB Visa Infinite's lack of annual fees further enhances this combination, leaving only the CIMB Travel World Mastercard's annual fee to consider, which can be waived with RM120,000 in annual spending. This is a rare find in the Malaysian market, where many cards excel in either local or overseas spending but not both.

It's crucial to note that the CIMB Travel World Mastercard and CIMB Visa Infinite combination is not the definitive best strategy for everyone.

No single credit card fits all needs perfectly, unless one is willing to invest in the costly American Express Platinum Charge Card by Maybank.

The CIMB Visa Infinite may not be ideal for those with heavily concentrated spending in specific categories, as it rewards diversified local spending across multiple categories.

Be sure to check out my Ultimate Category-Specific Guide to find the best credit card depending on your needs.

Airport Lounge Access

I know how important it is to obtain information about lounge access at a glance, so if you're queuing up to enter a lounge in Malaysia, here's the important details about the CIMB Visa Infinite credit card:

-

Number of Lounge Access Passes: 8X per year

-

Spend Conditions: No spend conditions

I've compiled the list of eligible lounges you can access in Malaysia. Lounge Access List by CIMB Visa Infinite credit card in Malaysia:

-

Plaza Premium Lounge KLIA Terminal 1 Main Terminal Building

-

Plaza Premium Lounge KLIA Terminal 2 (Gateway@klia2)

-

Plaza Premium Lounge Penang International Airport International

-

Plaza Premium Lounge Penang International Airport Domestic

CIMB may update its list from time to time, so be sure to check out their list here if you don't see your lounge on the list above.

Cardholders receive 5X complimentary lounge visits within the first year, renewable annually with a minimum spend of RM60,000. This is a strong proposition, given that it's unlikely anyone around this income range would spend this amount per year.

Nevertheless, the CIMB Visa Infinite's zero annual fee is acknowledged, being the only airline miles credit card at the RM60,000 annual income range to do so.

However, a notable omission is the absence of access to the prestigious Plaza Premium First lounge at KLIA Terminal 1. This is surprising, as other CIMB Travel credit cards, including the CIMB Preferred Visa Infinite, do offer this benefit. The reasoning behind this exclusion remains unclear.

Despite this minor disappointment, CIMB otherwise delivers on its reputation for extensive lounge access. Cardholders can enjoy a broad network of lounges, albeit potentially sharing the Plaza Premium Lounge with UOB and Maybank cardholders.

Final Thoughts

The CIMB Visa Infinite emerges as a compelling option in the RM60,000 annual income credit card segment. Its revamped features, particularly the unique tier-based rewards system and generous lounge access, cater to the average Malaysian household's diverse spending patterns.

While the absence of Plaza Premium First lounge access and the potential competition for bonus points pose minor drawbacks, the card's competitive local airline miles accrual rate and excellent overseas earning rate make it a noteworthy contender.

For those seeking a balanced credit card that rewards both local and overseas spending, especially those prioritizing Avios accumulation or frequent travel to Europe and the Middle East, the CIMB Visa Infinite, paired with the CIMB Travel World Mastercard, presents an enticing proposition.

However, individuals with highly concentrated spending habits might find more tailored options elsewhere. Ultimately, the CIMB Visa Infinite's appeal lies in its adaptability to a wide range of spending behaviors and its strategic alignment with CIMB's broader credit card ecosystem.

Be sure to check out my Enrich Ultimate Guide, KrisFlyer Ultimate Guide, Asia Miles Ultimate Guide, Airport Lounge Ultimate Guide and my newly published Ultimate Category-Specific Guide to compare the best credit cards in Malaysia for earning airline miles.

Credit Card Updates

Credit Card News

Join the Mailing List

Subscribe to our newsletter to stay on top of the latest credit card updates and news.

Thank you for subscribing!

![[UPDATED] AmBank Drops KrisFlyer and Asia Miles for Non-Priority Banking Credit Cards](https://static.wixstatic.com/media/d8e41b_819de997e98e4044af9f3cd5983a1e73~mv2.png/v1/fill/w_319,h_179,fp_0.50_0.50,q_95,enc_avif,quality_auto/d8e41b_819de997e98e4044af9f3cd5983a1e73~mv2.webp)