Last Updated: 5/10/2024

Recommendation: Consider

Annual Fee

-

RM554

-

Waived with RM120k spend

Airport Lounge Access

-

12X access per year

-

International Lounges

-

Supplementary Access

-

Spend Conditions

Annual Income

-

RM100,000 per annum

Airline Miles Earn Rate

Local: 0.13 MPR

Airlines: 0.64 MPR

Overseas: 0.64 MPR

Payment Network

Review | CIMB Travel World Mastercard

The CIMB Travel World Mastercard occupies a unique position, nestled between the premier CIMB Travel World Elite and the more accessible CIMB Travel Platinum Mastercard.

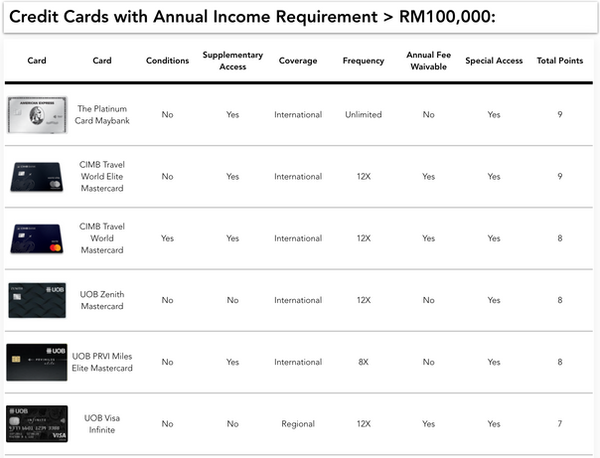

It requires an annual income of RM100,000, aligning it with some of the industry’s most coveted credit cards. Notably, reaching an annual income of RM100,000 typically marks a pivotal moment for enthusiasts in the airline miles landscape, unlocking access to a range of prestigious credit cards.

Therefore, the CIMB Travel World Mastercard could be considered a key player in CIMB’s portfolio of travel-oriented credit cards. But how does it stack up against the elite contenders in this competitive field? Let’s explore.

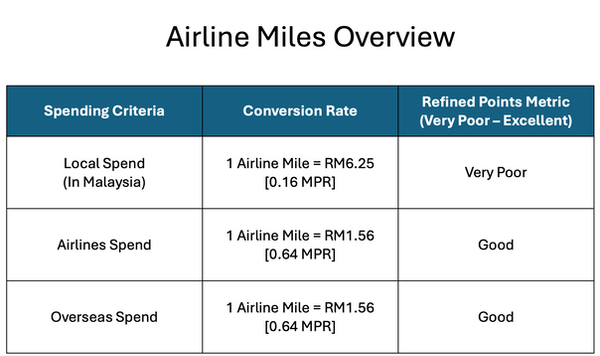

Air Miles Conversion

Much like its counterparts, the CIMB Travel World Elite and CIMB Travel Platinum Mastercard, the CIMB Travel World Mastercard shares a similar local earning rate.

This could be seen as a disadvantage for the CIMB Travel World Elite, particularly when compared to other cards in this income bracket, which often feature equally uninspiring local airline miles accrual rates.

However, there is little new information to add about the CIMB Travel World Mastercard’s earn rate; it remains subpar for local spending. To truly benefit from this card, one must fully engage with CIMB’s suite of offerings, optimizing the potential to maximize local miles accumulation.

A strategic pairing of cards, such as the recently revamped CIMB Visa Infinite alongside the CIMB Travel World Mastercard, can prove beneficial. I've covered this in detail below.

It is important to note the bonus points pooling feature when using any CIMB credit cards. Unlike the UOB system, where higher-tier cards offer superior conversion rates to airline miles compared to lower-tier UOB credit cards, CIMB maintains a uniform bonus points to miles conversion rate across all its cards.

The CIMB Travel World Mastercard rewards users with 8X Bonus Points for every RM1 spent on airlines and overseas transactions, including online purchases in foreign currencies.

For those familiar with my Ultimate Guide series, you’ll recall that the CIMB Travel World Mastercard’s Miles Per Ringgit (MPR) is somewhat modest compared to others in its income bracket. We’ll delve deeper into comparisons later, but first, let’s focus on the card’s advantages.

As noted in my review of the CIMB Travel World Elite, a significant benefit of CIMB credit cards is their versatility in converting bonus points into various frequent flyer programs. Currently, CIMB stands out as the only bank in Malaysia offering conversions to several unique frequent flyer programs, including Qatar Airways Avios—home to the world’s top business class.

However, with an MPR of 0.64 (Enrich) on overseas and airline expenditures, it falls short when compared to the UOB PRVI Miles Elite, which boasts an MPR of 0.83 on overseas spend. The real value comes into play when considering the specific airline miles conversion.

For instance, a one-way business class ticket on Malaysia Airlines from Kuala Lumpur to London requires 149,300 Enrich miles, whereas the same ticket on Qatar Airways costs just 75,000 Avios—almost half the mileage cost. Let's not talk about the hard and soft product comparison between the two, because I would GLADLY pay 149,300 Avios to sit in Qatar Airways' QSuites any given day!

This makes the CIMB Travel World Mastercard an excellent choice for those who frequently travel to Western and European destinations. However, if you’re primarily collecting Enrich Miles (which I'm puzzled as to why), this card may not align with your goals.

Likewise, if you are looking to redeem Bonus Points for Airasia BIG Points just because of the conversion rate, I strongly suggest you close this page immediately and head to a different blog for credit card tips! Redeeming credit card points for Airasia miles at any given time is akin to paying RM30 for a plate of chicken rice!

I am a staunch advocate for miles conservation—using airline miles strategically for the most valuable routes. In this regard, the most critical frequent flyer conversion offered by CIMB is to British Airways Avios.

Notably, several airlines, including Qatar Airways and Finnair, now utilize Avios as their mileage currency. Although CIMB directly converts to Qatar Airways Avios, it does not yet for Finnair. However, the Avios ecosystem facilitates easy transfers of miles between British Airways and Finnair, which is a significant advantage. Finnair, known for its safety and exceptional service, often offers compelling value on business class flights from Singapore to Helsinki.

For those frequenting routes to Europe, the CIMB Travel World Mastercard can be quite beneficial, especially for those favoring Middle Eastern carriers.

However, for travelers focusing on destinations in Asia like Japan or South Korea, other credit cards with better MPR values for Enrich and Asia Miles might be more appropriate.

Special Deep Dive | A Comparison of Credit Cards

When surveying the competitive landscape, the CIMB Travel World Mastercard faces stiff competition from two notable contenders: the UOB PRVI Miles Elite and the Maybank 2 Cards Premier. It’s important to recognize that no single card offers a 'one-size-fits-all' solution—each has its strengths and weaknesses depending on individual spending habits and needs.

The UOB PRVI Miles Elite, for instance, provides nearly 1.5x the overseas Miles Per Ringgit (MPR) of the CIMB Travel World Mastercard but falls short in terms of lounge access. Conversely, the Maybank 2 Cards Premier offers a slightly superior local spending MPR compared to both the UOB and CIMB cards, but converting TreatsPoints to airline miles can be frustrating, especially with the current issues surrounding Maybank.

The real choice often comes down to the UOB PRVI Miles Elite versus the CIMB Travel World Mastercard. Deciding between these two should start with which bank's ecosystem aligns best with your lifestyle. The UOB PRVI Miles Elite, with its modest 0.08 MPR for local spending, it’s less appealing for those who spend most of their time domestically. In either scenario, you would likely need an additional card to truly maximize your airline miles accrual.

On the other hand, if your expenses span different categories, the recently revamped CIMB Visa Infinite, which offers bonus points after reaching a monthly spending threshold, might be a better fit.

Keep in mind that I'm assuming RM3,000 spend on Dining monthly for the CIMB Visa Infinite in my calculations above.

As always, this is meant to be an illustrative example.

In terms of annual fees, the CIMB Travel World Mastercard is mostly on par with its competition. The annual fees are waived with a minimum spend of RM120,000 annually, which is steeper than the requirements for the Maybank 2 Cards Premier.

Airport Lounge Access

I know how important it is to obtain information about lounge access at a glance, so if you're queuing up to enter a lounge in Malaysia, here's the important details about the CIMB Travel World Mastercard credit card:

-

Number of Lounge Access Passes: 12X per year

-

Supplementary Access: Yes, quota is shared with principal cardholder

-

Spend Conditions: 3X access per quarter with RM6,000 spend

I've compiled the list of eligible lounges you can access in Malaysia. Please note that it's difficult for me to have the whole list of lounges here, as the CIMB Travel World Elite credit card has access to over 200+ lounges globally.

Lounge Access List by CIMB Travel World Elite credit card in Malaysia:

-

Plaza Premium First KLIA Terminal 1 Main Terminal Building

-

Plaza Premium Lounge KLIA Terminal 1 Main Terminal Building

-

Plaza Premium Lounge KLIA Terminal 2 (Gateway@klia2)

-

Plaza Premium Lounge Langkawi International Airport

-

Plaza Premium Lounge Penang International Airport International

-

Plaza Premium Lounge Penang International Airport Domestic

CIMB may update it's list from time to time, so be sure to check out their list here.

The CIMB Travel World Mastercard offers an intriguing yet restrictive lounge access feature: despite granting 12X lounge access passes per year, the conditions attached are quite stringent.

For a card requiring an annual income of RM100,000, it’s surprising that CIMB insists on spend-based conditions for lounge access. Even more frustrating is the quarterly limit of 3X lounge accesses.

If you hold three supplementary cards—for your wife and two children—and meet the RM6,000 quarterly spending requirement, unfortunately, one child will still be left without lounge access. I have previously criticized CIMB’s perplexing policies regarding lounge access, but the imposition of a quarterly cap on passes is particularly disappointing.

Recently, CIMB updated its terms to extend the validity of lounge access passes to one year, contingent upon meeting spending conditions. However, this adjustment offers little solace to new cardholders who may have imminent travel plans with their families but haven’t yet met the spending threshold.

Why not simplify the process by providing 12 complimentary lounge accesses annually with a minimum total spend of RM24,000? This would effectively maintain the same spending requirement but distribute the benefit more user-friendly throughout the year.

The good news is that lounge Access via the CIMB Travel World Mastercard credit card is shared between Principal and Supplementary Cardholders. There is a total of 12X lounge access granted, with CIMB's special feature being that cardholders have access to Plaza Premium First. I previously wrote about how amazing the Plaza Premium First lounge is, and why you should visit it instead of the regular Plaza Premium Lounge!

Check out my Ultimate Airport Lounge Guide to compare the lounge access benefits for various credit cards in Malaysia.

Final Thoughts

In conclusion, the CIMB Travel World Mastercard presents a mixed bag of features that cater to a specific type of traveler.

While it excels in areas such as airline and overseas spending with an 8X Bonus Points rate, and offers versatility through its conversion options to various frequent flyer programs like British Airways Avios, it falls short in others.

Furthermore, despite its competitive position between the CIMB Travel World Elite and CIMB Travel Platinum Mastercard, its overall value proposition is overshadowed by competitors like the UOB PRVI Miles Elite, which offers superior overseas MPR and better-suited benefits for frequent international travelers.

For those deeply embedded in the CIMB ecosystem or frequently flying with Middle Eastern carriers, the CIMB Travel World Mastercard might still hold appeal, especially given its unique conversions to Qatar Airways Avios.

However, for travelers prioritizing comprehensive lounge access, straightforward benefits, and robust mileage earning capabilities across a broader range of airline partners, exploring alternatives might prove more advantageous. As always, aligning credit card choices with your specific travel patterns and spending habits is crucial to maximizing the benefits received from any travel-related credit card offering.

Be sure to check out my Enrich Ultimate Guide, KrisFlyer Ultimate Guide, Asia Miles Ultimate Guide and my brand-new Ultimate Category-Specific Guide to compare the best credit cards in Malaysia for earning airline miles.

Credit Card News

Credit Card Updates

Join the Mailing List

Subscribe to our newsletter to stay on top of the latest credit card updates and news.

Thank you for subscribing!