Last Updated: 5/10/2024

Recommendation: Obtain

Annual Fee

-

RM1215

-

Waived with RM240k spend

Airport Lounge Access

-

12X access per year

-

International Lounges

-

Supplementary Access

Annual Income

-

RM250,000 per annum

Airline Miles Earn Rate

Local: 0.13 MPR

Airlines: 0.8 MPR

Overseas: 0.8 MPR

Payment Network

Review | CIMB Travel World Elite

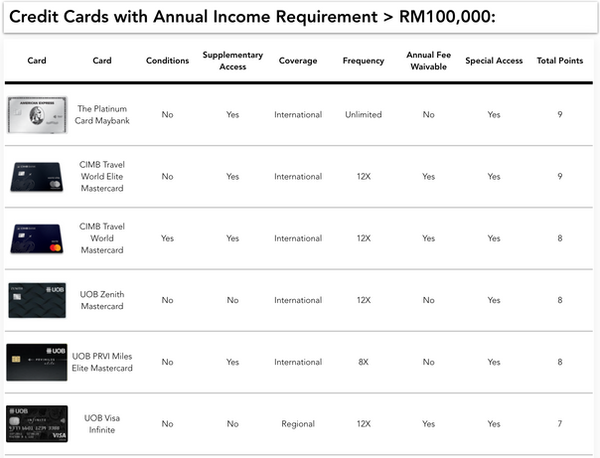

The CIMB Travel World Elite credit card is CIMB's highest tier non-preferred credit card which is targeted towards high net worth customers. Refined Points ranks this card as one the best credit cards in Malaysia for accruing air miles, but only if you have a combination of other CIMB credit cards to complement this card.

It is also my top pick for airport lounge access in Malaysia, ranking No.1 in my Top 10 Credit Cards for Airport Lounge Access.

With a minimum annual income requirement of RM250,000, you can expect the card to host a ton of benefits, including a special benefit that is otherwise uncommon in the industry.

Air Miles Conversion

With its current local earn rate, the CIMB Travel World Elite credit card ranks among the least favorable options in its income segment for accruing airline miles. However, not all is lost.

A significant advantage of the CIMB credit cards is their extensive range of conversion partners, many of which are firsts in Malaysia. For instance, it is rare to find another Malaysian credit card offering conversions to Qatar Airways Avios. The poor conversion rate of HSBC TravelOne's Avios, which borders on taking newcomers to the airline miles game for fools, should not even be considered in this comparison.

Despite the low local earn rate, an effective strategy to counter this is to explore other cards within CIMB’s ecosystem that can complement the CIMB Travel World Elite. It is unusual to find a Malaysian credit card that offers equally attractive benefits for both local and overseas spending, due to the high costs associated with funding these benefits, particularly in terms of miles.

Banks typically purchase airline miles in bulk, and overly generous conversion rates could lead to a rush of customers, potentially causing market imbalance. This was evident in the TreatsPoints issue with the Maybank 2 Cards Premier.

One of the strengths of CIMB credit cards is the pooling of Bonus Points. While this feature is not unique to CIMB, the card lineup includes some excellent options that can address the shortcomings of the CIMB Travel World Elite, such as the CIMB Preferred Visa Infinite for dining spend and the CIMB e Card for spend on the 28th of each month, which I will discuss in more detail in the future.

Regarding overseas airline miles accrual, this is where the CIMB Travel World Elite excels.

It’s important to address a key point: the CIMB Travel World Elite, requiring an annual income of RM250,000, is not the top credit card in Malaysia for earning airline miles through overseas spending. For instance, even the UOB PRVI Miles Elite offers a 0.83 MPR for overseas spending, which is nearly 30% higher than CIMB's 0.64 MPR for KrisFlyer and Asia Miles.

However, the appeal of the CIMB Travel World Elite lies in its ability to convert points to a wide array of travel partners.

Experienced airline miles enthusiasts understand that the major challenge in redeeming miles for flights is seat availability. While miles per ringgit is significant, securing a seat, particularly for business class on popular routes, is the real hurdle. This is a frequent issue with Singapore Airlines KrisFlyer. Despite Singapore Airlines being renowned for its exceptional service, high demand from global credit card holders makes finding Saver award availability difficult, often requiring bookings 10-12 months in advance.

The CIMB Travel World Elite's extensive range of airline partners mitigates this issue, provided users navigate the system effectively.

For instance, the card's conversion to Qatar Airways Avios opens opportunities to book QSuites on popular European routes without struggling for award availability on oneworld carriers like Malaysia Airlines Enrich or Cathay Pacific Asia Miles.

For example, you can fly in Qatar Airways QSuites from KL to London one-way for 75,000 Avios, compared to 149,300 Enrich miles for Malaysia Airlines Business Class. The difference in quality between the two airlines is stark, with Qatar Airways offering a superior product in terms of luxury and prestige.

To accumulate 75,000 Avios, you would need to spend RM113,000 overseas on the CIMB Travel World Elite. In contrast, earning 149,300 Enrich miles would require RM187,000 in spending.

Additionally, airline spend also earns you 10X Bonus Points with the CIMB Travel World Elite. By concentrating your airline spending on this card throughout the year, you can accrue a substantial number of points, enabling a valuable redemption by year-end.

Be sure to check out my Enrich Ultimate Guide, KrisFlyer Ultimate Guide and Asia Miles Ultimate Guide for comparisons on the airline miles earning rates for various credit cards.

Special Deep Dive | Waived 1% Overseas Spend Fee

When you use your CIMB Travel World Elite card abroad, you pay the exact exchange rate set by Mastercard, the card’s network. CIMB does not add any extra percentage on top. This is a significant benefit because many credit cards typically include a foreign transaction fee of around 2-3%.

The UOB PRVI Miles Elite is well known to have a high overseas fee as reported on various forums and channels.

Normally, when you make a transaction in a foreign currency, there is a small fee (approximately 1%) charged by the bank for currency conversion. With the CIMB Travel World Elite card, this fee is waived.

You might wonder how CIMB and Mastercard generate revenue if these fees are waived. There are several other ways this is achieved:

-

Interchange Fees: These fees are paid by the merchant’s bank to the cardholder’s bank for each transaction. Even if the cardholder does not pay a foreign transaction fee, the merchant’s bank still does.

-

Interest Charges: If you do not pay your credit card balance in full each month, the bank will charge interest, which can be a substantial source of revenue.

-

Annual Fees: The CIMB Travel World Elite card carries an annual fee of RM1215, providing another revenue stream for the bank.

-

Other Services: Banks offer a variety of financial products and services such as loans, investments, and insurance. The revenue generated from these services can offset the waived fees on credit cards.

The waived fees and no markup strategy by CIMB is designed to attract frequent travelers. These cardholders tend to spend more, thus generating more interchange fees for the bank. Additionally, these customers are often more affluent and may be interested in other banking products and services.

This feature is likely to appeal to seniors in the financial industry who are not primarily focused on accumulating airline miles aggressively. These individuals, accustomed to purchasing business and first-class flights with cash, view airline miles accrual as an additional benefit rather than a primary incentive. For them, the waived 1% fee represents a significant cost-saving measure.

Airport Lounge Access

I know how important it is to obtain information about lounge access at a glance, so if you're queuing up to enter a lounge in Malaysia, here's the important details about the CIMB Travel World Elite credit card:

-

Number of Lounge Access Passes: 12X per year

-

Supplementary Access: Yes, quota is shared with principal cardholder

-

Spend Conditions: No spend conditions

I've compiled the list of eligible lounges you can access in Malaysia. Please note that it's difficult for me to have the whole list of lounges here, as the CIMB Travel World Elite credit card has access to over 200+ lounges globally.

Lounge Access List by CIMB Travel World Elite credit card in Malaysia:

-

Plaza Premium First KLIA Terminal 1 Main Terminal Building

-

Plaza Premium Lounge KLIA Terminal 1 Main Terminal Building

-

Plaza Premium Lounge KLIA Terminal 2 (Gateway@klia2)

-

Plaza Premium Lounge Langkawi International Airport

-

Plaza Premium Lounge Penang International Airport International

-

Plaza Premium Lounge Penang International Airport Domestic

CIMB may update it's list from time to time, so be sure to check out their list here.

The CIMB Travel World Elite credit card has excellent lounge access, with no strange conditions unlike other CIMB credit cards. It also has access to one of the widest lounge networks in Malaysia. I believe that CIMB has the widest list of lounges available to its cardholders as of March 2024.

Check out my Ultimate Airport Lounge Guide to compare the lounge access benefits for various credit cards in Malaysia.

Lounge Access via the CIMB Travel World Elite credit card is shared between Principal and Supplementary Cardholders. There is a total of 12X lounge access granted, with CIMB's special feature being that cardholders have access to Plaza Premium First. I previously wrote about how amazing the Plaza Premium First lounge is, and why you should visit it instead of the regular Plaza Premium Lounge!

Nonetheless, for a top-of-the-line credit card with an annual fee over RM1,000, I expected much more from CIMB in regard to number of access passes granted per year. In particular, I wish they would have followed UOB's steps to separate lounge access passes for each supplementary cardholder.

In contrast, high level cards from Ambank and Maybank do not limit lounge access to a certain number of entries per calendar year. The Ambank Signature Priority Banking credit cards offer unlimited access to lounges for principal and supplementary cardholders, while The Platinum Card from Maybank offers a generous selection of lounges with unlimited access in addition to 12X access to Plaza Premium First lounges. Both cards have a lower income requirement than the CIMB Travel World Elite credit card.

You can access the full list of lounges available here.

Other Travel Benefits

The CIMB Travel World Elite credit card offers a range of benefits tailored specifically for travelers. While features like free in-flight Wi-Fi are noteworthy, the card’s status as a World Elite Mastercard provides access to a variety of exclusive benefits courtesy of Mastercard. Among these, the complimentary one-night stays stand out as particularly valuable. You can explore the full range of promotions on the Priceless portal.

One notable benefit is the Complimentary 12-Month HotelLux membership. Although it sounds appealing, it's worth noting that the privileges it offers might come at a cost compared to booking directly through the hotel’s own platform.

Additionally, the CIMB Travel World Elite card provides a unique benefit of a three-night stay at Wyndham Asia properties in Bali or Phuket. To qualify for this offer, cardholders must spend a minimum of RM10,000 in the same month as their travel. Previously, a similar promotion was available for Marriott properties in Phuket and Bali.

These partnerships with hotel chains are intriguing and add significant value to the card, especially since these offers come with certain spending conditions. Overall, this benefit is a valuable addition to the card’s travel perks.

Final Thoughts

The CIMB Travel World Elite credit card presents a mixed bag of features and benefits that cater primarily to frequent travelers.

While its local earn rate for airline miles is less competitive, the card compensates with an extensive array of conversion partners, including unique options like Qatar Airways Avios. This flexibility can be particularly advantageous for securing flights on popular routes without the common issues of seat availability.

The card’s overseas earn rate, though not the highest in its category, is bolstered by the ability to convert points to multiple travel partners, providing significant value for strategic travelers. Additionally, the no-markup policy on foreign exchange rates and the waiver of the usual currency conversion fee enhance its appeal to those who frequently travel abroad, ensuring more cost-effective spending.

Beyond miles accrual, the CIMB Travel World Elite card offers an impressive suite of travel-related benefits. These include access to exclusive World Elite Mastercard perks, complimentary hotel stays, and specialized promotions with top hotel chains. While some benefits, like the HotelLux membership, may offer less value compared to direct bookings, the overall package provides substantial advantages.

In summary, the CIMB Travel World Elite credit card stands out for its diverse travel benefits, extensive conversion options, and cost-saving features. While it may not be the top choice for earning airline miles domestically, its strategic advantages and unique offerings make it a compelling option for frequent and discerning travelers.

Be sure to check out my Ultimate Guide, KrisFlyer Ultimate Guide and Asia Miles Ultimate Guide for comparisons on the airline miles earning rates for various credit cards.

Credit Card News

Credit Card Updates

Join the Mailing List

Subscribe to our newsletter to stay on top of the latest credit card updates and news.

![[UPDATED] AmBank Drops KrisFlyer and Asia Miles for Non-Priority Banking Credit Cards](https://static.wixstatic.com/media/d8e41b_819de997e98e4044af9f3cd5983a1e73~mv2.png/v1/fill/w_319,h_179,fp_0.50_0.50,q_95,enc_avif,quality_auto/d8e41b_819de997e98e4044af9f3cd5983a1e73~mv2.webp)