Alliance Bank Visa Infinite

Last Updated: 5/10/2024

Recommendation: Obtain

Annual Fee

-

RM438

-

Waived with RM12,000 Spend

Airport Lounge Access

-

2X Access + 1X TCL

-

International Lounges

Annual Income

-

RM60,000 per annum

Airline Miles Earn Rate

Local: 0.53 MPR

Online: 0.53 MPR

Groceries: 0.33 MPR

Dining: 0.33 MPR

Overseas: 0.33 MPR

Payment Network

Review | Alliance Bank Visa Infinite

Alliance Bank has been on a roll lately, being the first in Malaysia to launch a digital virtual credit card which I can't be bothered to review as it certainly does not cater to the travel-focused individual like myself.

However, many of my friends have been going on and on about the revamped benefits of the Alliance Bank Visa Infinite Credit Card lately, which made me curious about the benefits it offers.

For those unaware, Alliance Bank revamped both their Visa Platinum and Visa Infinite credit cards back in 2020, but I'm writing this review today to encompass the latest changes to the credit card that have just taken place this month in the form of a full review.

If you're keen on earning Enrich Miles and ONLY Enrich Miles, read on to understand whether this credit card deserves a place in your wallet. If you're not at all interested in Enrich Miles or Malaysia Airlines, I suggest you visit my other credit card reviews, as the Alliance Bank Visa Infinite is not for you.

Card Design

I'm starting off my review slightly different for the Alliance Bank Visa Infinite. I can't help but be mesmerized by the beautiful design of the credit card!

It reminds me of the fintech cards that I used to get when I still back in the UK doing my degree. Interestingly, I'm starting to see more and more banks in Malaysia adopting these kinds of card designs, which is honestly a huge positive given the lacklustre design elements credit cards had in the last few years locally.

Air Miles Conversion

Let's not waste time and get straight to the point. The points you earn by spending your Alliance Bank Visa Infinite credit card are called 'Timeless Bonus Points (TBP)'. Again, I have to remind you that the points you earn by swiping your card is not the amount of airline miles you earn.

Each bank has different conversion rates from their own points system to airline miles, and understanding this is the first step to being a smart credit card consumer.

Of course, many of my friends were instantly attracted to the '8X TBP' marketing gimmick by Alliance Bank but read on to see whether these points are actually worth anything.

I previously wrote about how Alliance Bank has devalued its airline miles accrual by 50% in March, and this has now taken effect by the time my review is up. Obviously, with such stellar airline miles earning rate, Alliance Bank likely had its strategy backfired, as many are likely to take advantage of this.

Nevertheless, even with the latest devaluation of the Alliance Bank Visa Infinite, I would recommend you to obtain this credit card immediately.

Now, the bad news is that Alliance Bank only offers conversion to Airasia points or Enrich Miles. Obviously, you should not even consider redeeming your Timeless Bonus Points for Airasia points, as this would simply be a waste of points. Hence, I am only focusing on the Enrich miles earning rate for the Alliance Bank Visa Infinite.

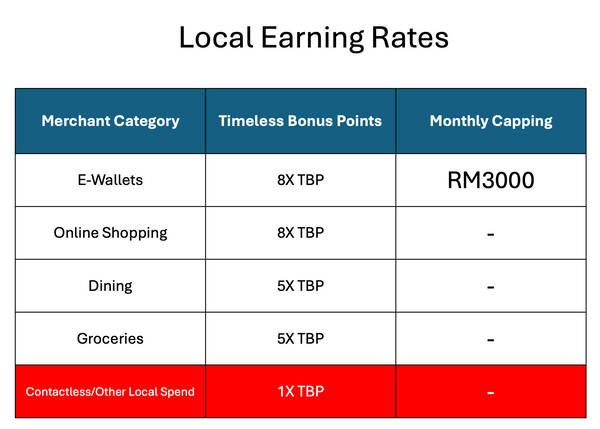

The Alliance Bank Visa Infinite offers 8X TBP for Online Shopping and E-Wallet top-ups.

In order to maximize your TBP earnings, you MUST top up your E-Wallets using your Alliance Bank Visa Infinite credit card, and NOT spend with your Alliance Bank Visa Infinite directly!

Please take note and understand what I'm trying to say. Many of my friends simply do not read the fine print, and they simply go ahead and make contactless or PIN transactions using their Alliance Bank Visa Infinite credit card, which only earns you 1X TBP!!

In fact, this is not a negative feature in any way, because many merchants such as small business owners do not even accept credit cards for payment, so you're better off using your E-Wallets to pay, and topping up your E-Wallets with your Alliance Bank Visa Infinite.

Now, I know some of you will eventually ask me if it's still worth to top up your E-Wallets given that some of them (like TNGD) have imposed credit card top-up fees.

My response is still the same, and if you truly know how much airline miles are worth, that 1% top up fee is completely meaningless and you should simply absorb the cost.

With that being said, Alliance Bank imposes a RM3,000 capping on E-Wallet top-ups for each month, meaning you can only earn a maximum of 24,000 TBP each month via E-Wallet top-ups.

This is not a bad thing whatsoever, but rather something that we can build around.Hence, the strategy is simple. Each month, simply reload your E-Wallets with RM3,000 using your Alliance Bank Visa Infinite, and use that respective E-Wallet as your main payment driver for your everyday spend.

Literally everywhere in Malaysia accepts E-Wallet payments, so this is definitely a pro, rather than a con!Last but not least, if you are a frugal spender, and simply do not spend more than RM3,000 every month, then be smart and utilize an E-Wallet that has several benefits.

For example, I know someone that tops up his TnG E-Wallet with RM3,000 every month using his Alliance Bank Visa Infinite, and he simply invests a portion of that money into Principal Investment Fund, which you can do so directly on the TnG E-Wallet app.

With that being said, if you strategically follow my guide and top up at least RM3,000 monthly into your E-Wallet, you're guaranteed 24,000 TBP each month. This translates to a total of 288,000 TBP each year, and remember, this is only for E-Wallet top ups.

If you want to take it a step further, I encourage you to utilize the 8X TBP earning rate on Online Spend as well, which may very well earn you plenty of extra TBP each month.

Let's summarize and categorize the Alliance Bank Visa Infinite TBP earnings as follows:

-

Local Earn Rate: 1 Enrich Mile = RM1.875 [Via E-Wallet]

-

Local Dining Rate: 1 Enrich Mile = RM3.00

-

Local Grocery Rate: 1 Enrich Mile = RM3.00

-

Overseas Earn Rate: 1 Enrich Mile = RM3.00

Now that you fully understand the strategy behind using the Alliance Bank Visa Infinite, you can take full charge of your credit card spending.

In short, the best way to maximize your TBP earnings is to prioritize maximizing the RM3000 E-Wallet reload cap per month. Once you have exhausted this, you can proceed to swipe your card on Dining and Grocies, which also earns you 5X TBP and is uncapped.

With that being said, the last thing on the air miles agenda for the Alliance Bank Visa Infinite is the overseas earn rate.

Unfortunately, despite being Alliance Bank's top tier credit card, the Timeless Bonus Points you earn by swiping your card overseas is mediocre. With 5X TBP for overseas spend, you're better off even applying for the CIMB Travel Platinum Mastercard, which grants you 1 Enrich Mile for every RM2.50 spent overseas.

Airport Lounge Access

I know how important it is to obtain information about lounge access at a glance, so if you're queuing up to enter a lounge in Malaysia, here's the important details about the Alliance Bank Visa Infinite credit card:

-

Number of Lounge Access Passes: 2X per year/1X per year for Travel Club Lounges

-

Supplementary Access: No.

-

Spend Conditions: No spend conditions

I've compiled the list of eligible lounges you can access in Malaysia. Please note that it's difficult for me to have the whole list of lounges here, as the Alliance Bank Visa Infinite has access to over 100+ lounges globally.

Lounge Access List by Alliance Bank Visa Infinite credit card in Malaysia:

-

Plaza Premium Lounge KLIA Terminal 1 Main Terminal Building

-

Plaza Premium Lounge KLIA Terminal 2 (Gateway@klia2)

-

Plaza Premium Lounge Langkawi International Airport

-

Plaza Premium Lounge Penang International Airport International

-

Plaza Premium Lounge Penang International Airport Domestic

-

Travel Club Lounge KLIA Terminal 1 Satellite Terminal

-

Travel Club Lounge KLIA Terminal 2 Gate L

-

Travel Club Lounge KLIA Terminal 2 Gate P/Q (Opposite Sama-Sama Hotel)

-

Travel Club Lounge Kuching International Airport

-

Travel Club Lounge Kota Kinabalu International Airport

Alliance Bank may update its list from time to time, so be sure to check out their list here if you don't see your lounge on the list above and in the table below.

Alliance Bank offers 2X complimentary access to Plaza Premium Lounges worldwide. The list is indeed extensive and is on par with lounge access lists from top banks in Malaysia. You can view the full list of lounges here.

Take note that only Principal cardholders are entitled to lounge access, but with just 2X access per annum, you're not missing much as a supplementary cardholder. There are plenty of other better credit cards out there if you wish to obtain access for your supplementary cardholders, such as the Ambank or CIMB credit cards.

Interestingly enough, Alliance Bank offers complimentary access to Plaza Premium First only to Alliance Privilege Visa Signature credit cardholders, despite the Visa Infinite predominantly a more "premium" card with a higher annual income requirement.

Also, take note that Alliance Bank now grants 1X access per annum to Travel Club Lounges in Malaysia. I have written about this update extensively here.

Kudos to Alliance Bank for adding an additional lounge access token. If you had already utilized both your lounge access passes, you typically wouldn't be able to access the Travel Club Lounges. However, Alliance Bank has taken a different approach, and I'm writing to appreciate their customer-first approach towards this.

Just to recap, you should utilize this 1X pass at the Travel Club Lounge near Gates P/Q at KLIA Terminal 2. For those who don't know, the Travel Club Lounge situated at the Sama-Sama Hotel after the notoriously long walk from KLIA Terminal 2 Main Building is the only lounge available.

You'll find that most international flights will depart from Gates P/Q, and hence, if you have a gate there prior to your flight, a visit to the Travel Club Lounge is highly recommended. Previously, the only lounge available at KLIA Terminal 2 is the Plaza Premium Arrivals Lounge at Gateway@KLIA2, which I have also reviewed.

However, it is somewhat disappointing to see that the Alliance Bank Visa Infinite only grants you half the number of lounge access passes when compared to other credit cards in it's similar income category.

Final Thoughts

The Alliance Bank Visa Infinite credit card is officially the best credit card in Malaysia to accumulate Enrich Miles for its annual income category, but you must do so strategically.

It is without a doubt that this card is a must get if you are into Enrich Miles. With such a promising miles accrual rate, you should definitely use this card to reload your e-wallets and gain those points. Despite being limited to a maximum of RM3,000 monthly, it's definitely worth the gains. Ignore that RM438 annual fee, as it is waived with a minimum spend of RM12,000 annually, and that's easy to achieve with just four months of reloading your E-Wallets.

However, I must convey an important aspect to consider. If you're a frequent reader of my blog, you'll know that I continuously emphasize the importance of doing your research before committing to any credit card.

With that being said, the Alliance Bank Visa Infinite has one major flaw: the fact that you can only redeem Enrich Miles with this credit card (I don't even bother considering AirAsia, because it's a complete waste of money to redeem TBP for AirAsia points). As you've seen over the last few months, Malaysia Airlines has been going on a significant devaluation spree.

It now costs a crazy amount of Enrich miles to travel to some of my favourite destinations, such as London. As such, if you look at things from a different angle, one could say that the Alliance Bank Visa Infinite basically traps its consumers into redeeming Enrich miles despite the very poor redemption rates.

Now, that's not a problem if you're a big fan of Malaysia Airlines, but if you're a smart consumer, then you'll know that practically any airline in ASEAN has a better product than MAS, including our neighbour Singapore Airlines. Check out my KrisFlyer Ultimate Guide if you feel like you wish to consider earning KrisFlyer instead of Enrich miles.

Lastly, there is also a final solution for those who are already balls-deep into the Alliance Bank Visa Infinite or already have tons of Enrich miles, and that solution is to basically redeem your Enrich Miles for other oneworld carriers.

I'm going to write a separate Ultimate Guide on redeeming Enrich Miles for oneworld carrier airlines, such as Qatar Airways, Japan Airlines, Finnair, Cathay Pacific, and more.

Credit Card News

Credit Card Updates

Join the Mailing List

Subscribe to our newsletter to stay on top of the latest credit card updates and news.

Thank you for subscribing!

![[UPDATED] AmBank Drops KrisFlyer and Asia Miles for Non-Priority Banking Credit Cards](https://static.wixstatic.com/media/d8e41b_819de997e98e4044af9f3cd5983a1e73~mv2.png/v1/fill/w_319,h_179,fp_0.50_0.50,q_95,enc_avif,quality_auto/d8e41b_819de997e98e4044af9f3cd5983a1e73~mv2.webp)